When home buyers go into escrow in Three Sixty at some point they’ll find out that there is a mello roos in the community. In general it  means that there is a yearly addition to the normal property taxes. Here’s a bit of background as to what it is, why and how much.

means that there is a yearly addition to the normal property taxes. Here’s a bit of background as to what it is, why and how much.

What is Mello-Roos?

Background

In 1978 Californians enacted Proposition 13, which limited the ability of local public agencies to increase property taxes based on a property’s assessed value. In 1982, the Mello-Roos Community Facilities Act of 1982 (Government Code §53311-53368.3) was created to provide

an alternate method of financing needed improvements and services.

The Mello-Roos Community Facilities Act of 1982

The Act allows any county, city, special district, school district or joint powers authority to establish a Mello-Roos Community Facilities District (a “CFD”) which allows for financing of public improvements and services. The services and improvements that Mello-Roos CFDs

can finance include streets, sewer systems and other basic infrastructure, police protection, fire protection, ambulance services, schools, parks, libraries, museums and other cultural facilities. By law, the CFD is also entitled to recover expenses needed to form the CFD and

administer the annual special taxes and bonded debt.

What is a Mello-Roos?

A CFD is created to finance public improvements and services when no other source of money is available. CFDs are normally formed in undeveloped areas and are used to build roads and install water and sewer systems so that new homes or commercial space can be built. CFDs are also used in older areas to finance new schools or other additions to the community. This is why we see a mello-roos in 360 as it went to pay for the infrastructure for the community as it didn’t exist prior.

What is the Mello-Roos in Fusion?

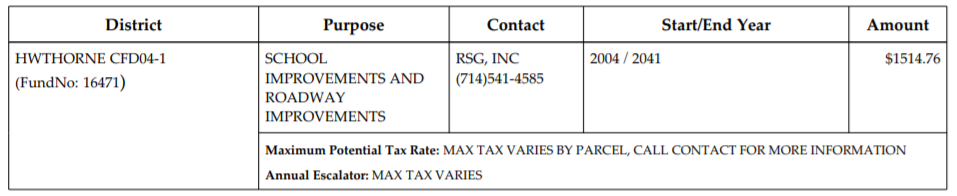

While the amount of the mello-roos can vary and can change the mello-roos for owners in Three Sixty is currently (and approximately) around $1500 annually. The table below is from a 2018 escrow with specific information at that time. While we cannot guarantee the information below the contact number listed is 714-541-4585 for updated information.

How is a Mello-Roos CFD Formed?

A CFD is created by a sponsoring local government agency. The proposed district will include all properties that will benefit from the improvements to be constructed or the services to be provided. A CFD cannot be formed without a two-thirds majority vote of residents living within the proposed boundaries. Or, if there are fewer than 12 residents, the vote is instead conducted of current landowners. In many cases, that may be a developer.

Once approved, a Special Tax Lien is placed against each property in the CFD. Property owners then pay a Special Tax each year. If the project cost is high, municipal bonds will be sold by the CFD to provide the large amount of money initially needed to build the

improvements or fund the services.

How is the Annual Charge Determined?

By law (Prop. 13), the Special Tax cannot be directly based on the value of the property. Special Taxes instead are based on mathematical formulas that take into account property characteristics such as use of the property, square footage of the structure and lot size. The

formula is defined at the time of formation, and will include a maximum special tax amount and a percentage maximum annual increase.

How Long Will the Charge Continue?

If bonds were issued by the CFD, special taxes will be charged annually until the bonds are paid off in full. Often, after bonds are paid off, a CFD will continue to charge a reduced fee to maintain the improvements. According to the information from the table above the Mello-Roos will end in 2041.

IMPORTANT TO KNOW:

• Rights to Accelerated Foreclosure. It is important for CFD property owners to pay their tax bill on time. The CFD has the right (and if bonds are issued, the obligation) to foreclose on property when special taxes are delinquent for more than 90 days. Additionally, any costs of collection and penalties must be paid by the delinquent property owner. This is considerably faster than the standard 5 year waiting period on county ad valorem taxes.

• Disclosure Requirement for Sellers (California Civil Code §1102.6). When reselling a property in a CFD, the seller must make a “good faith effort” to obtain a Notice of Special Tax from the local agency that levies the Special Tax, and provide it to the buyer.